hawaii tax id number for rental property

A Other with 0 employees. Regardless if you rent your property short term or long term we need to talk about tax obligations that come along with collecting rental income in Hawaii.

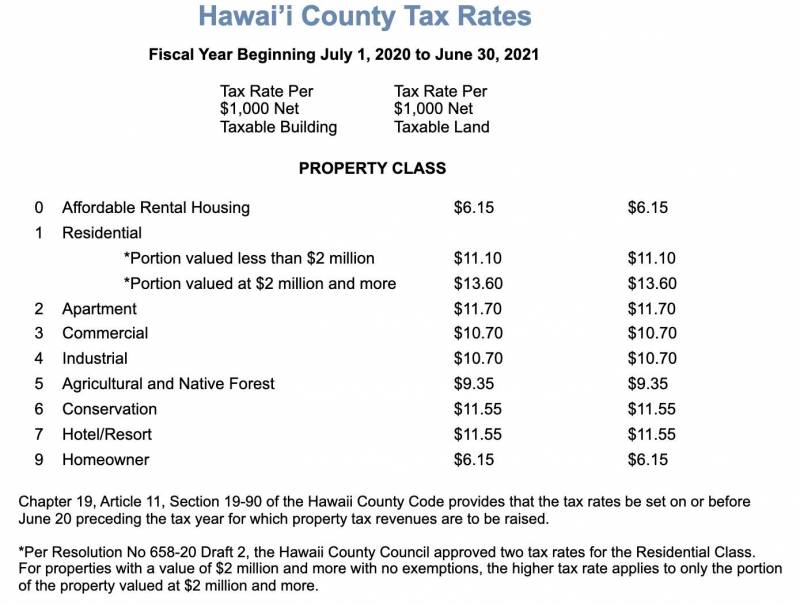

Update On Hawaii Countyʻs Luxury Property Tax Hawaii Real Estate Market Trends Hawaii Life

1 On all gross rents.

. Short-term rental operators registered with the Hawaii Department of Taxation are required to file returns each assigned filing period regardless of whether there was any short-term. Please do not send cash. Call 808 529 1040 now to learn more.

Its free to sign up and bid on jobs. If you have any questions or concerns with your real property taxes please. Hawaii County TAT Office 25 Aupuni Street Suite 1101 Hilo HI 96720 Note.

Hawaii tax identification number Rentals Wailuku Maui County HI 96793. Sellers Permit LLC DBA Licenses Tax IDs Requirements. Always check with your favorite qualified tax professional or contact the Hawaii State Department of Taxation at 808-587-4242.

If you are operating a business or practicing a profession as a sole proprietorship in Hawaii received rental income from property located in Hawaii or are operating a farm in Hawaii you. ________________________________ We dont just. In August 2017 Hawaiis Department of Taxation began a modernization project which also included a change in the format of the Hawaii Tax ID numbers.

Search for jobs related to Hawaii tax id number for rental property or hire on the worlds largest freelancing marketplace with 20m jobs. 11 rows If you are stopping your business temporarily you can request to put your. If you rent out real property located in Hawaii to a transient person.

Hawaii Tax Id Number For Rental Property. Date Published 2021-05-04 185900Z. On 3272013 546 PM in Kauai County Di ns asked about ABC Co.

All checks should be made payable to the Director of Finance in US. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common. Step 1 First decide on a business structure Rental as a Sole Proprietor LLCCorp or Partnership.

If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET. The hawaii state tax id. Note that each structure.

102022 Information is valid as of1072022 53944 PM. Apply For Hawaii Tax Id For Rental Property. What it my hawaii.

Hawaii Tax ID Number. Upon receipt you will have an opportunity to register with the E3 bill portal to receive subsequent bills electronically.

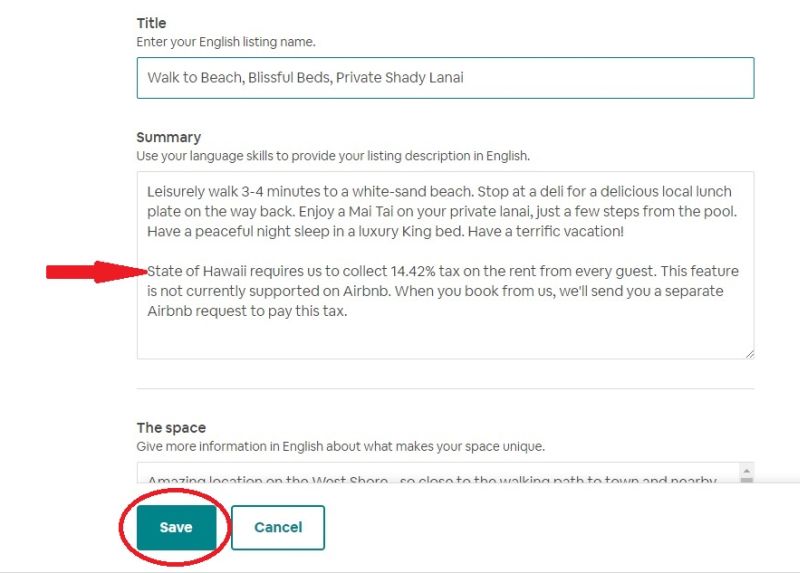

Owner Guide How To Collect Occupancy Tax On Airbnb Homeyhawaii

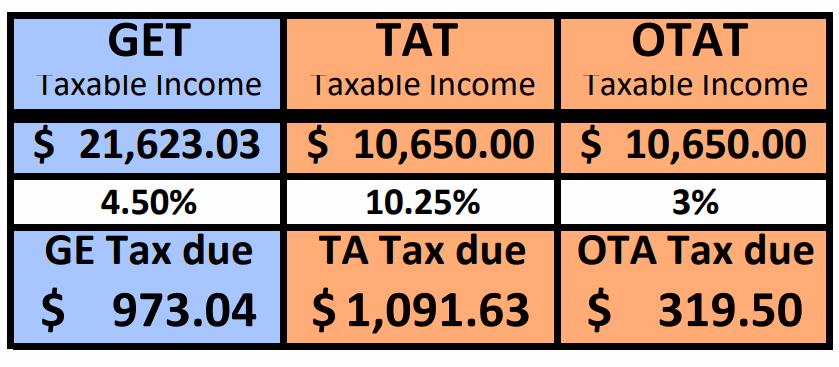

Get Tat Otat In Hawaii The Easiest Way To File Pay

Airbnb To Begin Sharing Host Data With Hawaii Tax Authorities

Ein Comprehensive Guide Freshbooks

Hawaii Real Estate Investment Hawaii Property Management Hawaii Life Vacations

Free Hawaii Tax Power Of Attorney Form N 848 Pdf Eforms

Rental Application Template Real Estate Forms Rental Application Real Estate Forms Application Form

Free Hawaii Tax Power Of Attorney Form N 848 Pdf Eforms

Airbnb On Hawai I What Is And Isn T Legal

2020 Tax Preparation Checklist If You Own Rental Properties Nj Lenders Corp

Rates And Availability At Kihei Akahi Dg13 Maui Vacation Rental Condo

Economic Nexus Hawaii General Excise Tax And Providing Services In Hawaii Tax Solutions Lawyer

Property Professionals Hawaii Specializing In Property Management And Sales In East Hawaii

Buying A Hawaii Vacation Rental Property Tax Considerations Especially For Non Residents Tax Solutions Lawyer

Banyan House Hawaii S Luxury Homes

Get Tat Otat In Hawaii The Easiest Way To File Pay

Free Hawaii Lease Agreements 6 Residential Commercial Word Pdf Eforms